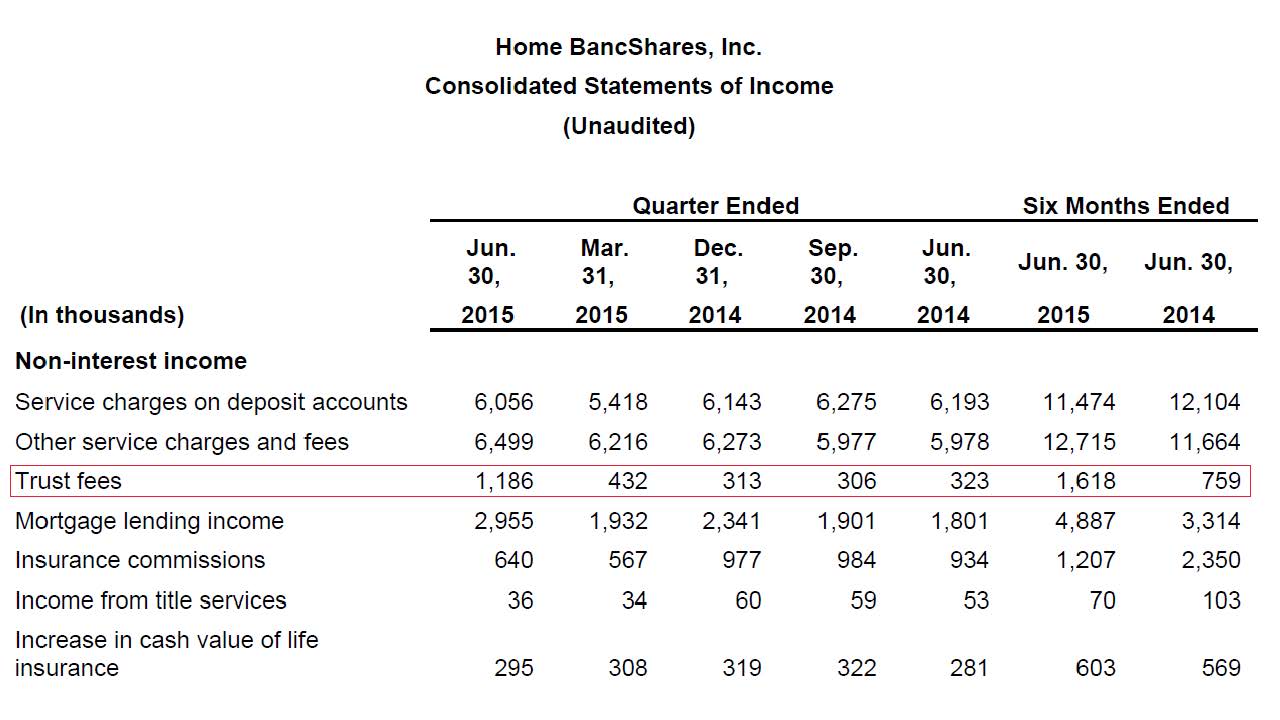

On July 16, 2015, HOMB reported its second quarter results. HOMB's CFO and Director for the previous 16 years, Randy Mayor, had just abruptly and unexpectedly "retired".

On an earnings conference call to discuss the quarter's results, Brian Davis, HOMB's new CFO commented, “The increase in trust fees includes a one-time receipt of $788,000 related to 12b-1 fees which were recovered from our Trust Department.”

How does a corporation recover fees from itself?

How does a corporation recover fees from itself?

What is a 12b-1 Fee?

A 12b-1 fee is an annual marketing or distribution fee on a mutual fund. The 12b-1 fee is considered to be an operational expense and, as such, is included in a fund's expense ratio. It is generally between 0.25 and 1% (the maximum allowed) of a fund's net assets.

The 12b-1 fee can be broken down into two distinct charges: the distribution and marketing fee and the service fee. The distribution and marketing piece of the fee is capped at 0.75% annually, while the service fee portion of the fee can be up to 0.25%.

Source: Investopedia

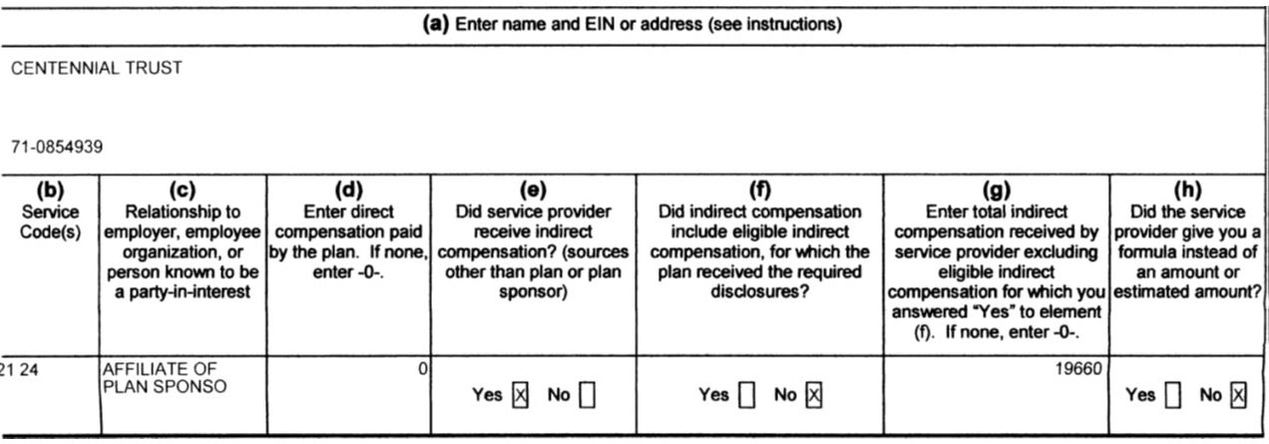

The Mystery Entity Appears On HOMB's 2014 Form 5500, Schedule C - 12b-1 Service Fees

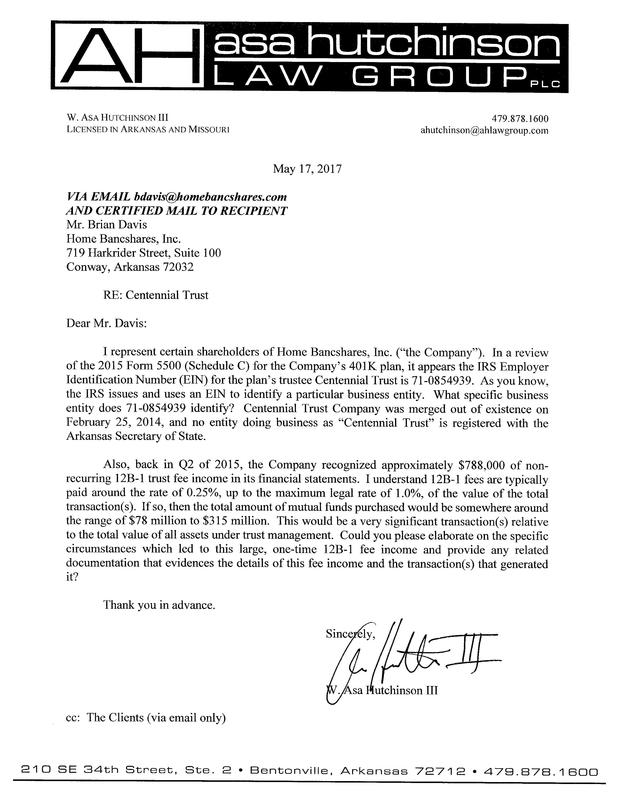

In 2014, the Mystery Entity (Tax ID 71-0854939), using the name "Centennial Trust", received $19,660 of 12b-1 service fees from mutual funds. The Service Codes listed below, 21 and 24, demonstrate the Mystery Entity provided "Trustee Services" to HOMB's own 401K Plan.

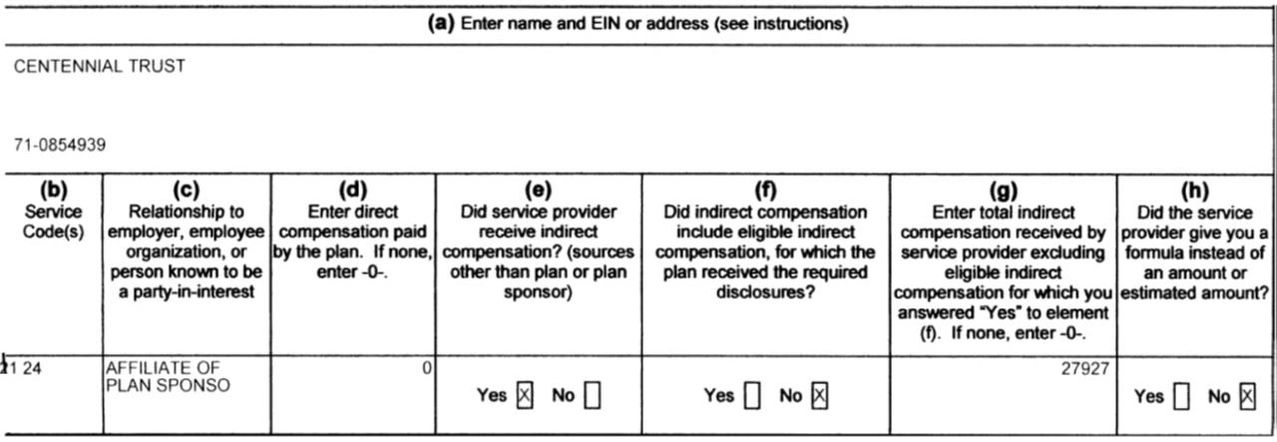

The Mystery Entity Appears On HOMB's 2015 Form 5500, Schedule C - 12b-1 Service Fees

In 2015, the Mystery Entity (Tax ID 71-0854939), again using the name "Centennial Trust", raked in $27,927 of 12b-1 service fees for Trustee Services provided to HOMB's 401K plan.

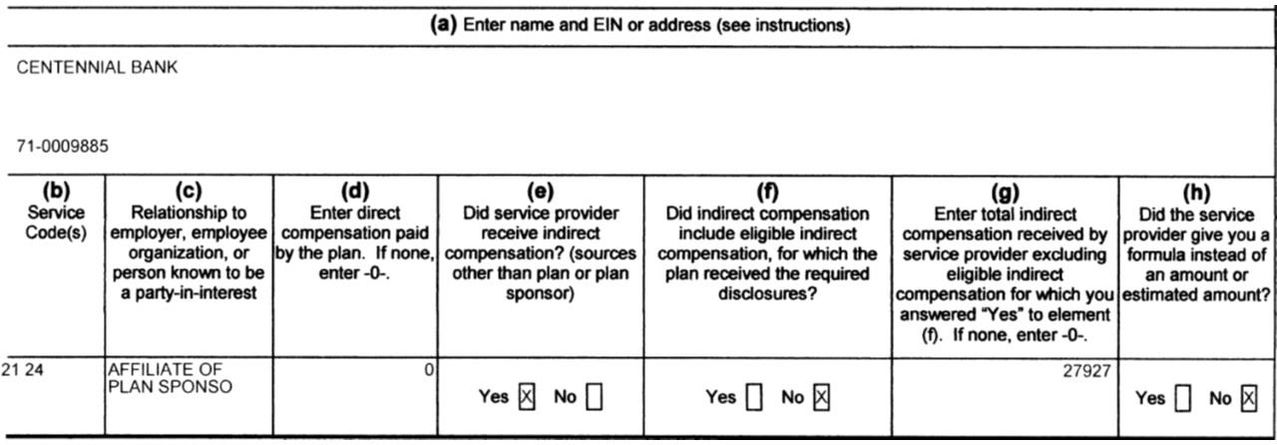

The Mystery Entity Is Subsequently Removed From HOMB's 2015 Form 5500, Schedule C - 12b-1 Service Fees

|

In letters to Brian Davis, HOMB's CFO and Board Member, shareholders requested that HOMB identify the specific business entity using Tax ID 71-0854939 and elaborate on the circumstances which lead to its strange recognition of 12b-1 fees. Although Mr. Davis ignored HOMB's shareholder requests, he did, however, quietly amend the 2015 Form 5500 for HOMB's 401K plan. Specifically, it appears Mr. Davis changed the entity that earned 12b-1 fees from the Mystery Entity (Tax ID 71-0854939), using the name "Centennial Trust", to "Centennial Bank" (Tax ID 71-0009885). |

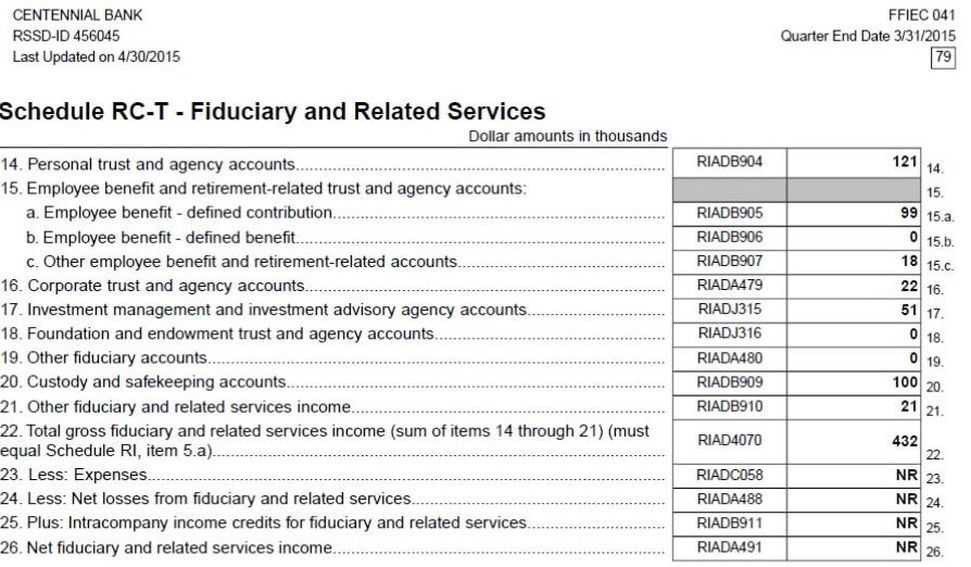

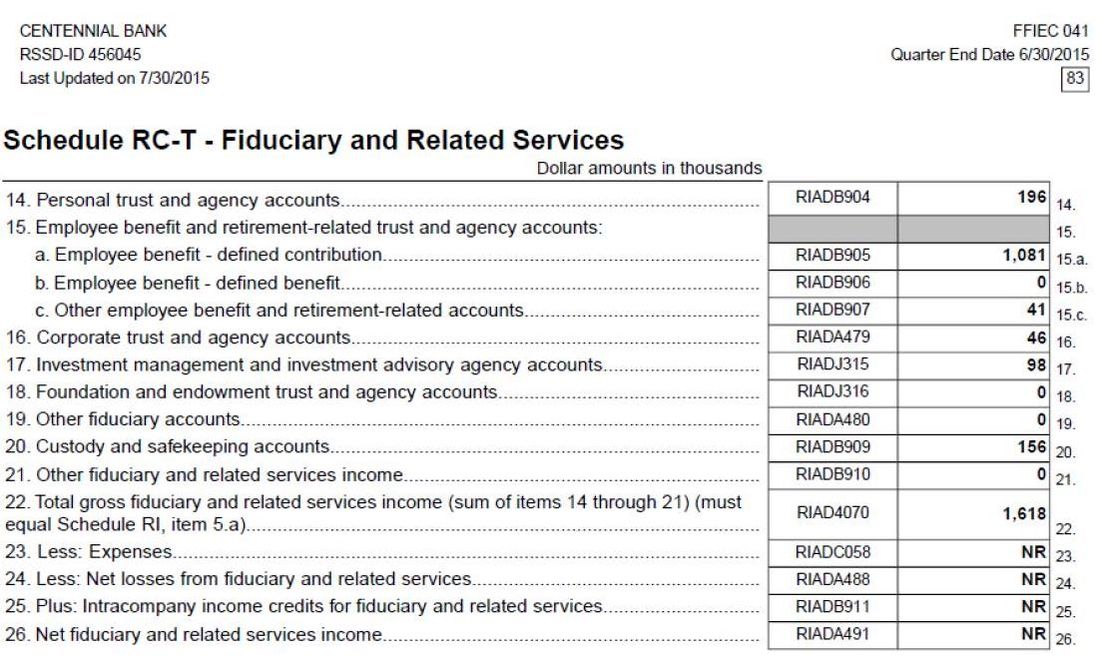

Fees Recovered From HOMB's "Trust Department" Were Earned Entirely On "Defined Contribution" Assets

Q1 2015 fees earned on "Defined Contribution" assets were $99,000.

By the end of Q2 2015, YTD fees earned on "Defined Contribution" assets totaled $1,081,000. Subtracting Q1 fees of $99,000 from $1,081,000 indicates Q2 fees were $982,000.

This is almost 10x Q1 2015's fees earned on "Defined Contribution" assets of $99,000.

One would assume this large increase in fees earned on "Defined Contribution" assets would reflect a proportional increase in "Defined Contribution" assets under management.

Yet "Defined Contribution" assets actually decreased during Q2 2015, declining from $145,533,000 (Q1 2015) to $137,639,000 (Q2 2015).

According to HOMB, during this period $788,000 of 12B-1 fees were recovered from its "Trust Department". HOMB refuses to elaborate.